Transparency and trust are not new topics of conversation in the world of programmatic advertising. However, over the last 12-18 months, we have seen these issues return to the fore as transparency across the media supply chain has become even more critical for ad buyers and sellers, especially in a year defined by a pandemic and global social unrest.

As consumers as well as the advertising industry at large shifted their focus toward digital content in 2020, media quality has taken centre stage for the advertising ecosystem.

The IAS Media Quality Report (MQR) is just one of the many ways we continue to build trust and transparency throughout the digital advertising ecosystem. The MQR provides benchmarks for viewability, time-in-view, brand safety, and ad fraud across digital environments and formats in the UK. It is based on the analysis of trillions of global data events each month from campaigns running between July 1st and December 31st 2020, providing the advertising community a barometer for the quality of digital media in the UK market.

Below we’ve outlined the key programmatic media quality trends in the second half of 2020 in the UK.

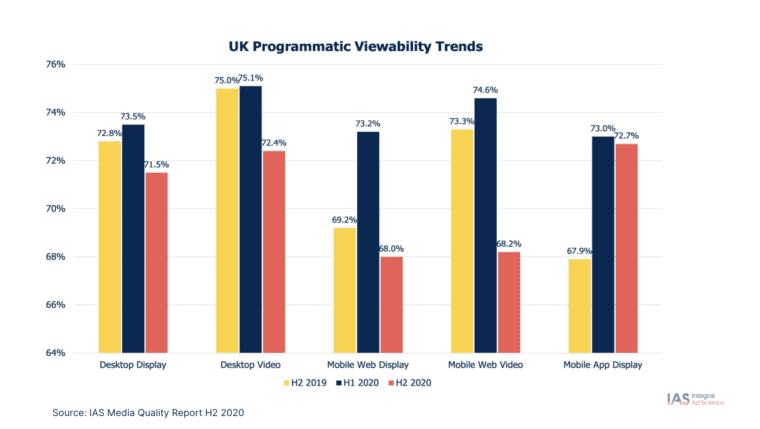

UK programmatic viewability decreased but continues to rank above global average

Viewability of UK ad impressions traded programmatically decreased for the first time across all environments, except mobile-app display. Programmatically purchased display inventory decreased across media environments due to growth in digital content consumption, increased demand and constraints on limited high quality ad inventory during the busy holiday period.

However, UK programmatic display inventory still ranks above global averages – desktop display viewability in the UK was 71.5% (versus the global programmatic average 69.8%) and mobile web display was 68.0% (versus the global programmatic average 63.5%).

UK mobile in-app environment has the highest viewability rate in the UK

Viewability within the mobile-app display environment increased 4.8 percentage points year-over-year (YoY) to 72.7% in H2 2020, increasing the ability for digital ads to be seen by consumers. This is likely as a result of wider adoption of the IAB Tech Lab’s Open Measurement Software Development Kit (OM SDK).

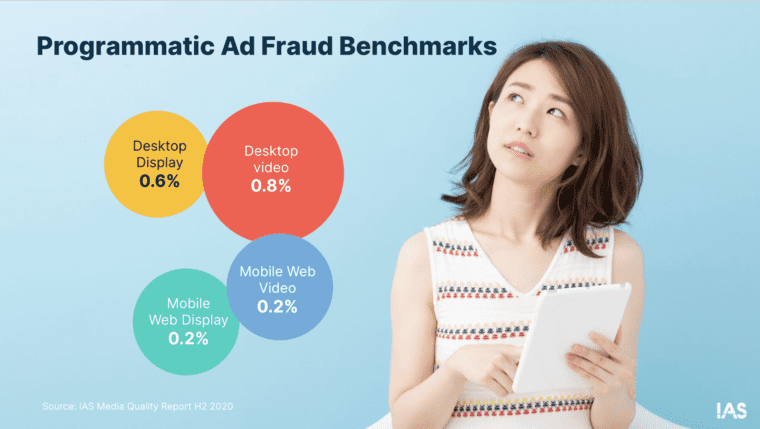

Ad fraud impacts less than 0.8% of programmatically traded inventory

In H2 2020, the volume of ad fraud detected in UK advertising decreased across all environments, except desktop video. The improvements have been mostly driven by impressions traded programmatically and due to the consistent use of optimised anti-fraud technology.

In contrast, programmatic campaigns that did not use optimisation tools and strategies encountered fraud levels up to 11 times higher than those optimised against ad fraud.

Programmatic improves time-in-view

Time-in-view refers to the average duration that a viewable impression remained in-view on the device screen. In H2 2020, brands were found to have between 15.64 seconds and 21.4 seconds to engage a UK consumer across pages purchased programmatically. Desktop display campaigns traded programmatically proved most engaging at 21.4 seconds, whilst mobile web display impressions drove the shortest time-in-view at 15.64 seconds.

Brand risk increases for the first time in three years

Amid turbulent times, UK brand risk increased across all media environments in H2 2020. Brand risk on programmatic desktop display rose 3.4 percentage points from H2 2019 to reach 5.9%. Brand risk on video formats traded programmatically experienced a lower rate of increase than display and still ranked well below global averages – desktop video increased to 6.6% (vs 8.4% to the global average) and mobile web video reached 7.9% (vs 9.1% to the global average). The increase of impressions flagged as posing a risk to brands were driven by a rise in adult, hate speech, and violent content categories.

To find out more about the UK’s media quality and how to better optimise digital campaigns, download the full report below.

Want to explore media quality insights, read our previous MQR reports

MQR H1 2020

MQR H2 2018

Share on LinkedIn

Share on LinkedIn Share on X

Share on X