Integral Ad Science Reports Third Quarter 2021 Financial Results

Total revenue increased 32% year-over-year to $79.0 million; programmatic revenue increased 49% to $33.7 million driven by contextual targeting adoption

Strong business momentum; increased full-year outlook

NEW YORK – November 10, 2021 – Integral Ad Science Holding Corp. (“IAS”) (Nasdaq: IAS), a global leader in digital media quality, today announced financial results for the third quarter ended September 30, 2021.

“We achieved impressive results in the third quarter as we deepened our partnerships with marketers, publishers, and platforms to maximize their target outcomes,” said Lisa Utzschneider, CEO of IAS. “IAS was first-to-market last year with programmatic contextual targeting solutions at scale. Even more customers adopted our Context Control offering this quarter as they prepare for a cookie-less world. In addition, we expect to advance our leadership in digital media quality in high-growth areas including CTV through our acquisition of Publica in the third quarter as well as in social media where we recently launched our brand safety solution for in-feed video ads on TikTok.”

Third Quarter 2021 Financial Highlights

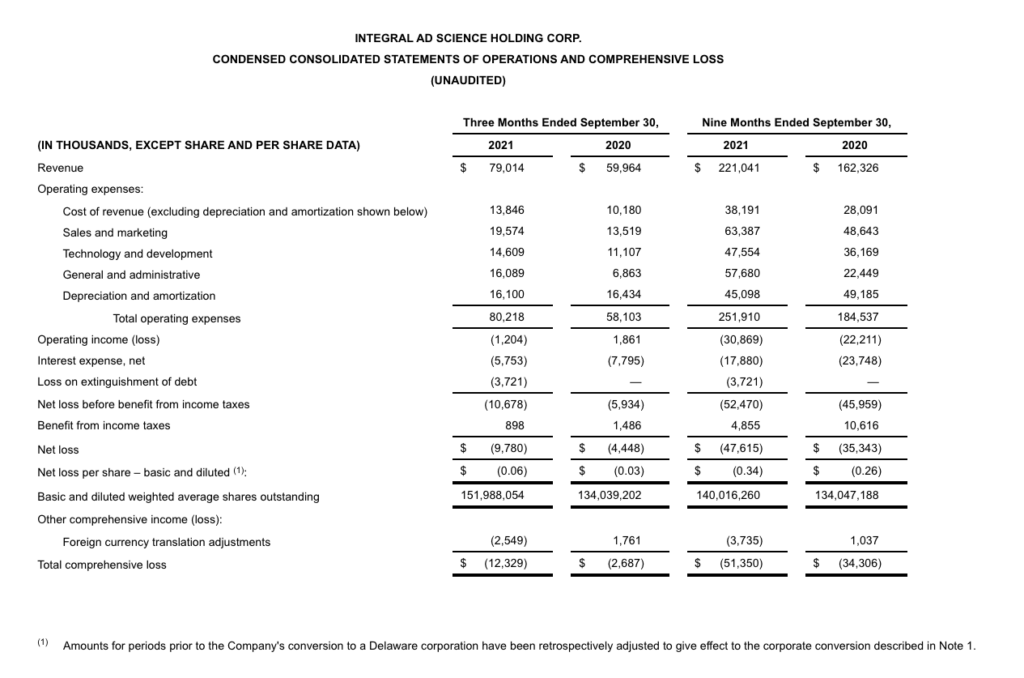

- Total revenue was $79.0 million, a 32% increase compared to $60.0 million in the prior-year period.

- Advertiser direct revenue was $34.4 million, a 15% increase compared to $30.0 million in the prior-year period.

- Programmatic revenue was $33.7 million, a 49% increase compared to $22.6 million in the prior-year period.

- Supply side revenue increased to $10.8 million which includes a partial quarter contribution from Publica, compared to $7.3 million in the prior-year period.

- International revenue, excluding the Americas, was $28.7 million, a 25% increase compared to $22.9 million in the prior-year period, or 36% of total revenue for the third quarter of 2021.

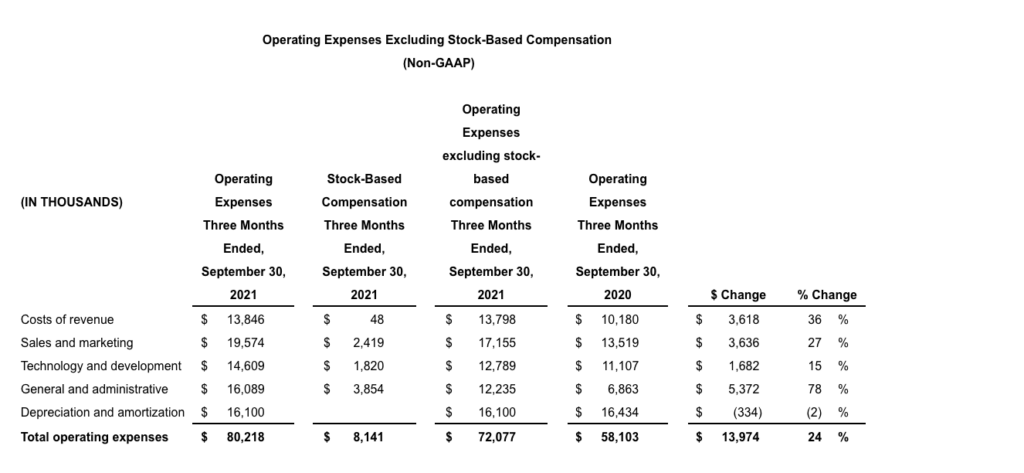

- Gross profit was $65.2 million, a 31% increase compared to $49.8 million in the prior-year period. Gross profit margin was 82% for the third quarter of 2021.

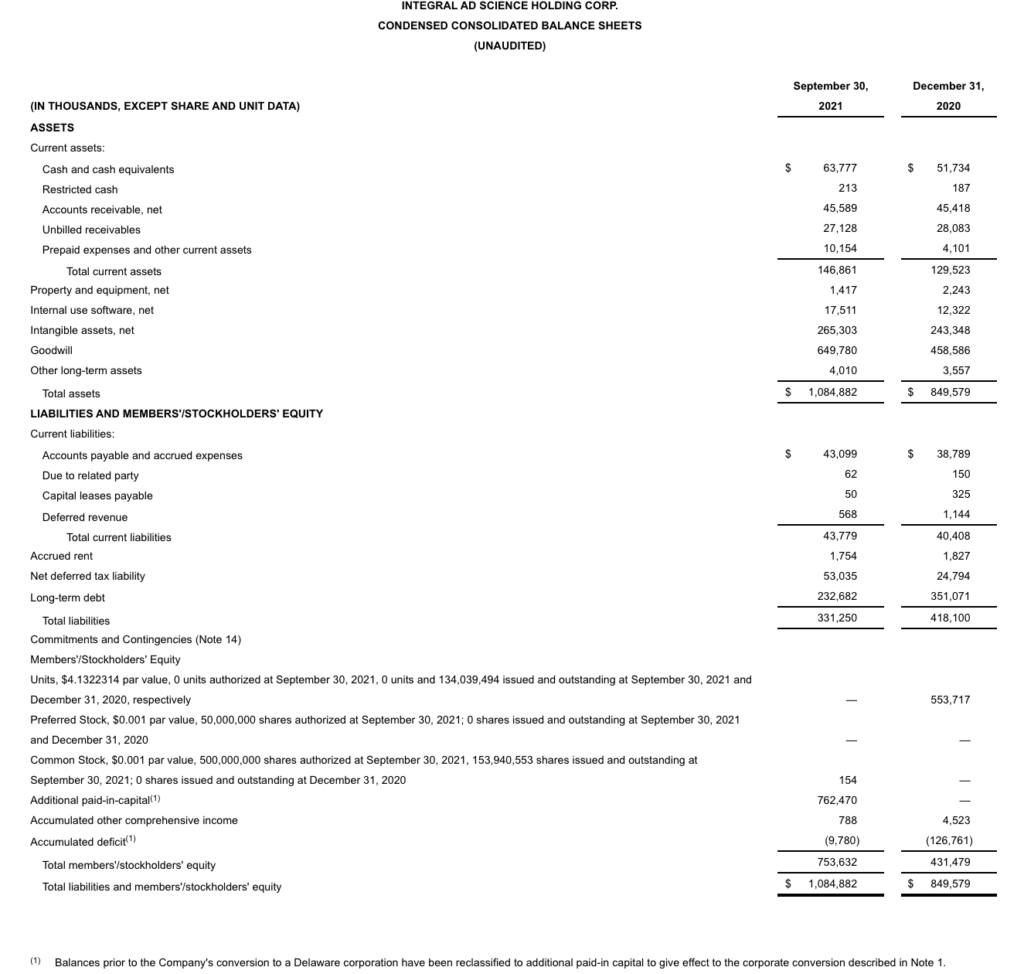

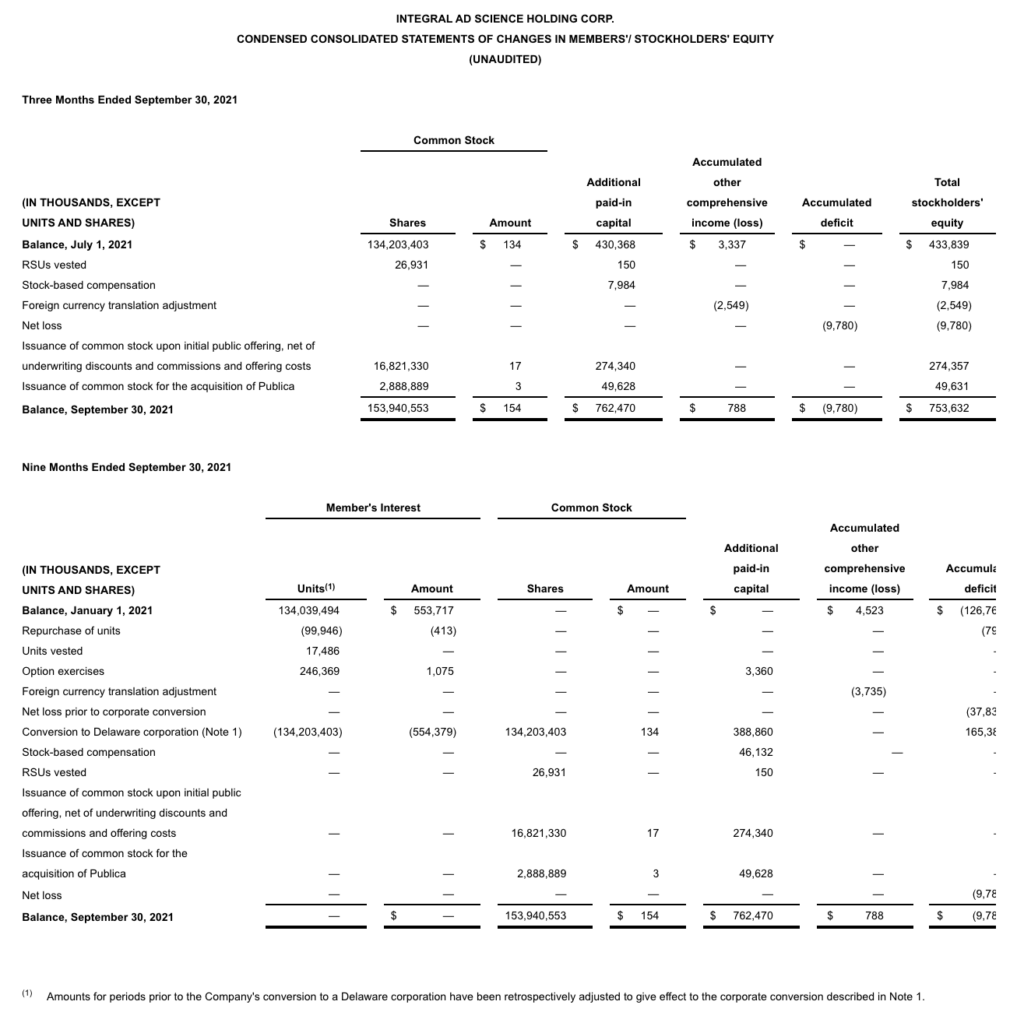

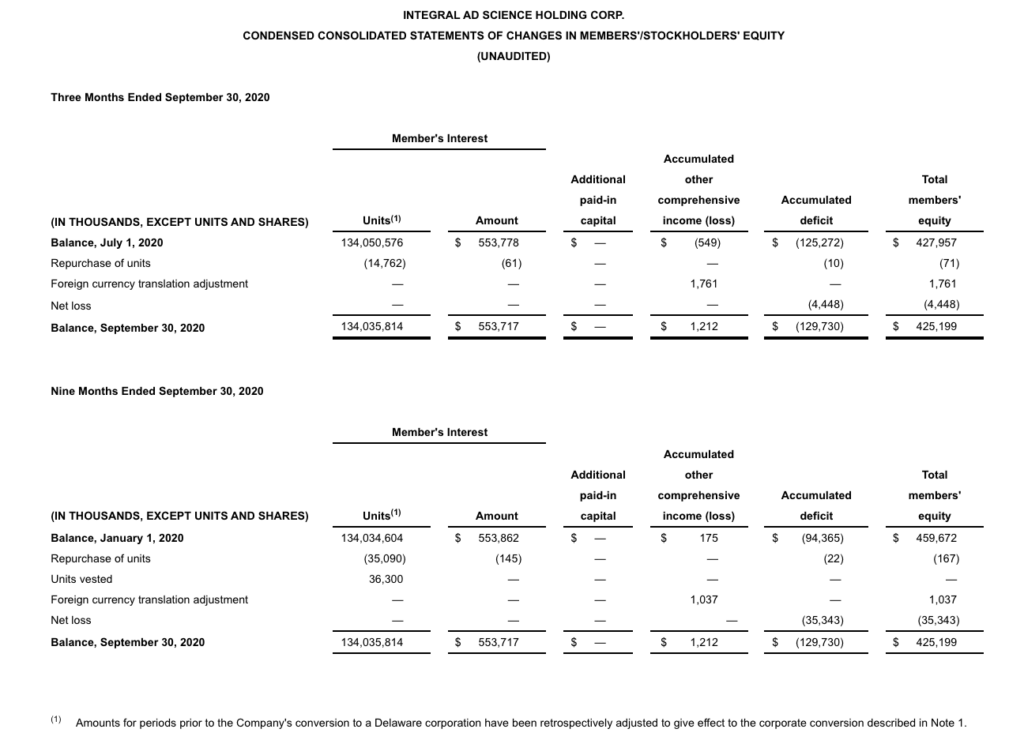

- Net loss was $9.8 million, or $0.06 per share, compared to a net loss of $4.4 million, or $0.03 per share, in the prior-year-period.

- Adjusted EBITDA* increased to $25.4 million compared to $18.5 million in the prior-year period. Adjusted EBITDA* margin was 32% for the third quarter of 2021.

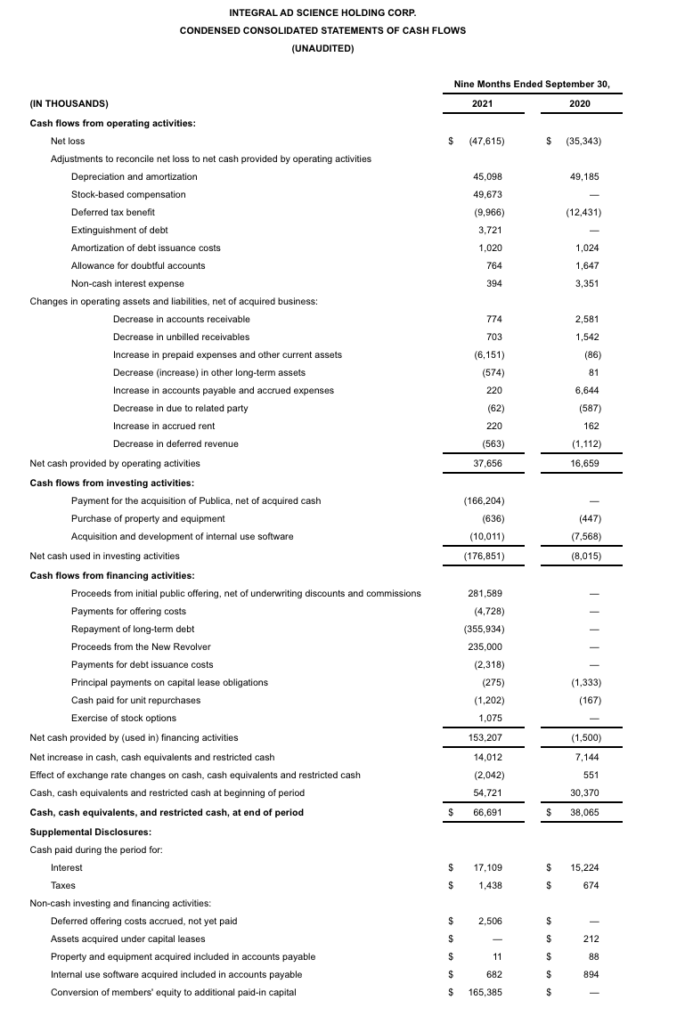

- Cash and cash equivalents were $63.8 million at September 30, 2021. During the third quarter, IAS replaced its existing credit facility with a new $300 million credit facility on more favorable terms.

Recent Business Highlights

- IAS has been accredited by the Media Rating Council (MRC) for impression and viewability measurement and reporting of display and video ads across Facebook and Instagram. The accreditation is further recognition of marketers’ reliance on IAS and its advanced technology to drive much needed transparency along with greater outcomes for their campaigns on social platforms.

- IAS launched IAS Signal, its new unified global reporting platform that delivers the data and insights advertisers and publishers need to manage their digital campaigns. IAS Signal incorporates several feature updates into one powerful platform, while setting a foundation for future innovation.

- IAS launched its new brand safety solution for in-feed video ads on TikTok, initially available in the U.S., France, and Germany, with additional markets expected soon. Brands including L’Oreal participated in the successful beta program.

- IAS released its latest Media Quality Report for H1 2021. The report showed that advertisers across the Americas achieved brand safety wins, while connected TV (CTV) viewability rates remained strong and desktop ads were more susceptible to ad fraud issues globally.

- IAS was the first ad verification provider to partner with the Global Disinformation Index (GDI) to help marketers avoid misinformation content based on GDI’s standards. This partnership is the latest example of how IAS protects brands from running ads on sites that have been identified for misinformation.

- Innovid expanded its partnership with IAS to maximize cross-device measurement, including CTV. IAS’s unified video solution gives Innovid clients access to reporting based on IAS metrics for invalid traffic as well as additional performance data.

- Viant expanded its partnership with IAS and integrated IAS’s CTV fraud pre-bid solution into the Adelphic DSP to enhance CTV fraud protection capabilities for brands and agencies.

- Publica continued to forge strong partnerships across the CTV landscape and announced new integrations with LiveRamp and Smart AdServer.

“We continued to drive revenue and margin performance in the third quarter while investing in our technology and people,” said Joe Pergola, CFO of IAS. “We realized double-digit growth in the period and extended our global footprint in new and existing markets. We also strengthened our balance sheet by improving our leverage ratio with access to capital on more favorable terms. Looking forward to our fourth quarter and the holiday season, we expect to continue our business momentum as highlighted by our increased full-year outlook.”

IAS is providing the following financial guidance for the fourth quarter of 2021 and increasing its full-year outlook:

Quarter Ending December 31, 2021:

- Total revenue in the range of $94 million to $96 million

- Adjusted EBITDA* in the range of $28 million to $30 million

Year Ending December 31, 2021:

- Total revenue in the range of $315 million to $317 million

- Adjusted EBITDA* in the range of $98 million to $100 million

* See “Supplemental Disclosure Regarding Non-GAAP Financial Information” section herein for an explanation of these measures.

Supplemental Disclosure Regarding Non-GAAP Financial Information

We use supplemental measures of our performance, which are derived from our consolidated financial information, but which are not presented in our consolidated financial statements prepared in accordance with GAAP. Adjusted EBITDA is the primary financial performance measure used by management to evaluate our business and monitor ongoing results of operations. Adjusted EBITDA is defined as earnings (loss) before depreciation and amortization, stock-based compensation, interest expense, benefit from income taxes, acquisition, restructuring and integration costs, IPO readiness costs and other one-time, non-recurring costs such as losses due to extinguishment of debt. Adjusted EBITDA margin represents the Adjusted EBITDA for the applicable period divided by the revenue for that period presented in accordance with GAAP.

We use non-GAAP financial measures to supplement financial information presented on a GAAP basis. We believe that excluding certain items from our GAAP results allows management to better understand our consolidated financial performance from period to period and better project our future consolidated financial performance as forecasts are developed at a level of detail different from that used to prepare GAAP-based financial measures. Moreover, we believe these non-GAAP financial measures provide our shareholders with useful information to help them evaluate our operating results by facilitating an enhanced understanding of our operating performance and enabling them to make more meaningful period-to-period comparisons. Although we believe these measures are useful to investors and analysts for the same reasons, they are useful to management, as discussed below, these measures are not a substitute for, or superior to, U.S. GAAP financial measures or disclosures.

IAS is unable to provide a reconciliation for forward-looking guidance of Adjusted EBITDA to net income (loss), the most closely comparable GAAP measure, because certain material reconciling items, such as depreciation and amortization, stock-based compensation, interest expense, income tax expense (benefit) and acquisition, restructuring and integration expenses, cannot be estimated due to factors outside of IAS’s control and could have a material impact on the reported results. Accordingly, a reconciliation is not available without unreasonable effort.

Reconciliation of Adjusted EBITDA to its most directly comparable GAAP financial measure, net loss, is presented below. We encourage you to review the reconciliations in conjunction with the presentation of the non- GAAP financial measures for each of the periods presented. In future fiscal periods, we may exclude such items and may incur income and expenses similar to these excluded items.

Conference Call and Webcast Information

IAS will host a conference call and live webcast to discuss its third quarter 2021 financial results today at 5:00 p.m. ET. To access the conference call, please dial U.S./Canada Toll-Free: 877-313-2138 International: 470-495-9538 Conference ID: 9022607. The webcast will be available live on IAS’s investor relations website: https://investors.integralads.com. A webcast replay will be available following the conclusion of the call.

About Integral Ad Science

Integral Ad Science (IAS) is a global leader in digital media quality. IAS makes every impression count, ensuring that ads are viewable by real people, in safe and suitable environments, activating contextual targeting, and driving supply path optimization. Our mission is to be the global benchmark for trust and transparency in digital media quality for the world’s leading brands, publishers, and platforms. We do this through data-driven technologies with actionable real-time signals and insight. Founded in 2009 and headquartered in New York, IAS works with thousands of top advertisers and premium publishers worldwide. For more information, visit integralads.com.

Forward-Looking Statements

This earnings press release contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this press release are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, growth rates and financial results or our plans and objectives for future operations, growth initiatives, or strategies are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including: (i) the adverse effect on our business, operating results, financial condition, and prospects from the current COVID-19 pandemic and related economic downturns; (ii) our dependence on the overall demand for advertising; (iii) our dependence on the overall demand for advertising; (iv) a failure to innovate or make the right investment decisions; (v) our failure to maintain or achieve industry accreditation standards; (vi) our ability to compete successfully with our current or future competitors in an intensely competitive market; (vii) our dependence on integrations with advertising platforms, demand-side providers (“DSPs”) and proprietary platforms that we do not control; (viii) our international expansion; (ix) our ability to expand into new channels; (x) our ability to sustain our profitability and revenue growth rate decline; (xi) risks that our customers do not pay or choose to dispute their invoices; (xii) risks of material changes to revenue share agreements with certain DSPs; (xiii) the impact that any future acquisitions, strategic investments, or alliances may have on our business, financial condition, and results of operations; (xiv) interruption by man-made problems such as terrorism, computer viruses, or social disruption impacting advertising spending; and (xv) other factors disclosed in the section entitled “Risk Factors” Prospectus filed with the SEC on July 1, 2021 in connection with our initial public offering. Given these factors, as well as other variables that may affect our operating results, you should not rely on forward-looking statements, assume that past financial performance will be a reliable indicator of future performance, or use historical trends to anticipate results or trends in future periods.

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. The forward-looking statements included in this press release are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Investor Contact:

Jonathan Schaffer / Lally Zirkle

ir@integralads.com

Media Contact:

Julie Nicholson

jnicholson@integralads.com