Brand risk improvements indicate return of confidence post-pandemic, according to new IAS report

The latest Media Quality Report provides global benchmarks for viewability, brand safety, and ad fraud across digital environments and channels

London, 18 October 2021: Integral Ad Science (Nasdaq: IAS), a global leader in digital media quality, today released its Media Quality Report for H1 2021. The report, based on trillions of data events analysed each month worldwide, provides transparency into the performance and quality of UK digital media and advertising placements in the first half of 2021, alongside worldwide comparisons.

The Media Quality Report highlights improvements across brand risk categories and video ad quality, indicating greater confidence and a drive towards video streaming following a year defined by the pandemic.

Brand risk improvements fueled by programmatic video buys

The UK led global brand risk reduction across video environments. The UK had the lowest levels of brand risk on desktop video compared to all other markets. Brand risk associated with desktop video decreased 4.1 percentage points from 5.7% in H1 2020 to 1.6% in H1 2021 – compared to the global average of 3.6%. Meanwhile, brand risk on mobile web video also decreased 4.1 percentage points from 6.3% in H1 2020 to 2.2% in H1 2021, versus the global average of 3.6%. Comparatively, brand risk across display formats remained consistent year-over-year (YoY), increasing by 0.1 percentage points across mobile web display and decreasing by 0.1 percentage points across desktop display.

Video inventory achieved even lower rates of brand risk when purchased programmatically, with mobile web video programmatic risk falling 3.6 percentage points to 2% in H1 2021, and desktop video programmatic risk decreasing by 3.9 percentage points to 1.4%.

Decreases in alcohol and disinformation content led brand risk improvements

The data revealed significant changes in brand risk share between content categories that pose a threat to brands:

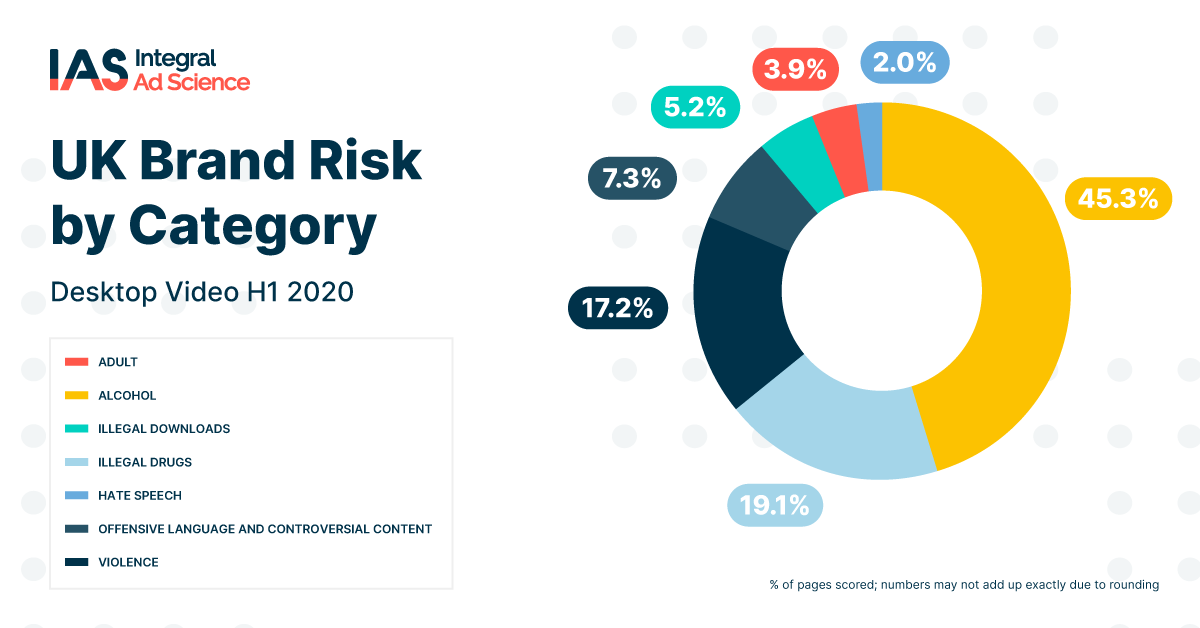

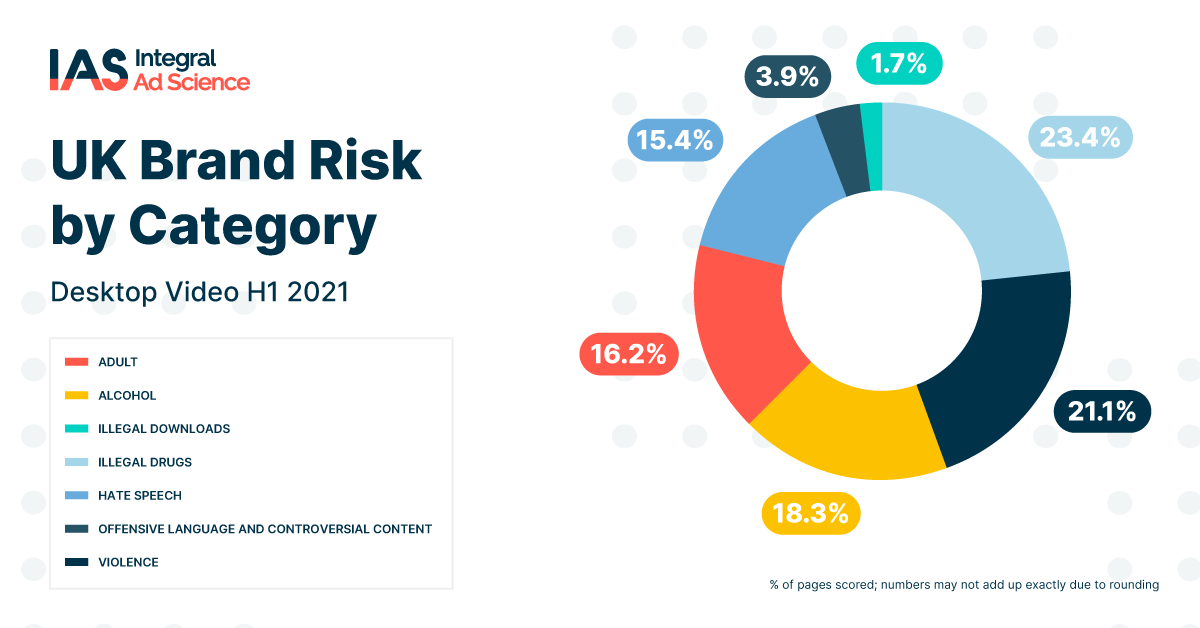

- There was a significant YoY improvement in the proportion of alcohol-related impressions flagged across all inventory types. In particular, desktop video decreased 27 percentage points from 45.3% in H1 2020 to 18.3% in H1 2021, while desktop display fell by 26.4 percentage points from 45.4% to 19%.

- Industry-wide efforts and greater education to reduce the prevalence of offensive language and fake news are proving successful. The risk of appearing near offensive or controversial content, such as disinformation, has reduced across all environments. Mobile web display led the way in this risk category as its share dropped 5.7 percentage points from 11.1% in H1 2020 to 5.4% in H1 2021.

- Adult, hate speech and violence content categories generally contributed a larger portion of brand risk across various environments when compared to the previous year. Specifically, the share of brand risk around adult content across desktop display increased 11.9 percentage points from 6.3% in H1 2020 to 18.2% in H1 2021. Hate speech across desktop video increased 13.4 percentage points from 2% to 15.4% in H1 2021. And violence also presented a brand safety threat, with 36.1% of mobile web video ad impressions flagged as posing a risk including content around violence.

Nick Morley, Managing Director, EMEA, at Integral Ad Science, commented:

“It’s interesting to compare brand safety risks to those of a year ago, when we were all navigating the unforeseen circumstances during the pandemic and a rise in misinformation. The distinct reduction in brand risk this year suggests that industry stability is resuming, with confidence increasing towards video ad inventory as the economy recovers. The improvement around misinformation reflects the industry’s commitment to supporting high-quality media outlets and publishers. More generally, we believe the move away from a blunt approach to brand suitability towards a nuanced contextual strategy means advertisers won’t inadvertently miss positive opportunities to interact with engaged audiences.”

Other key findings from the report include:

Video ads drive greater viewability and completion rates

Advertisers using video to engage with audiences found that they were more viewable than display ads. Viewability across mobile web video increased from 72.5% in H1 2020 to 74.9% in H1 2021, as did viewability across desktop video (from 73.5% to 74.4%). Additionally, 79% of viewable desktop video ads remained in view to completion, and 73.5% of mobile web video ads. In contrast, viewability across mobile web display decreased from 72.5% in H1 2020 to 69.2% in H1 2021, as did viewability across mobile app display (73.5% to 72.1%) and desktop display (72.9% to 71.5%).

Advertisers have less time to engage audiences in the UK, compared to global averages

Mobile app display showcased the sharpest drop of impressions that remained in view, decreasing from 24.51 seconds in H1 2020 to 18.12 seconds in H1 2021. Across desktop display, time-in-view of ads in the UK stood at an average of 21.16 seconds, compared to the global average of 22.67 seconds. This highlights advertisers’ need to ensure ads attract attention within a more competitive environment.

UK ad fraud rates remain below global average

Occurrences of ad fraud in the UK varied depending on ad inventory type, but still remained below global averages. Within advertising campaigns that used optimisation tools, the UK had the joint-second lowest level of ad fraud rates across mobile environments. On mobile web display, ad fraud decreased from 0.5% to 0.2% in H1 2021 (versus a global average of 0.4%). Even on desktop display, ad fraud increased from 0.6% to 0.9% in H1 2021, but was still below the global average of 1%. Campaigns that did not incorporate a form of fraud mitigation strategy encountered levels of fraud up to 13x higher worldwide.

Integral Ad Science’s H1 2021 Media Quality Report highlights brand safety, ad fraud, and viewability trends across display, video, mobile web, and app advertising. The Media Quality Report analysed trillions of global data events from ad campaigns that ran between January 1 to June 30, 2021. The full report can be viewed here.