The H1 2021 IAS Media Quality Report, based on trillions of data events analysed each month worldwide, provides transparency into the performance and quality of UK digital media and advertising placements in the first half of 2021, alongside worldwide comparisons.

The report highlights improvements across UK brand risk categories and video ad quality, indicating greater confidence and a drive towards video streaming following a year defined by the pandemic.

Brand risk improvements fueled by programmatic video buys

The UK led global brand risk reduction across video environments. The UK had the lowest levels of brand risk on desktop video compared to all other markets. Brand risk associated with desktop video decreased 4.1 percentage points from 5.7% in H1 2020 to 1.6% in H1 2021 – compared to the global average of 3.6%. Meanwhile, brand risk on mobile web video also decreased 4.1 percentage points from 6.3% in H1 2020 to 2.2% in H1 2021, versus the global average of 3.6%. Comparatively, brand risk across display formats remained consistent year-over-year (YoY), increasing by 0.1 percentage points across mobile web display and decreasing by 0.1 percentage points across desktop display.

Video inventory achieved even lower rates of brand risk when purchased programmatically, with mobile web video programmatic risk falling 3.6 percentage points to 2% in H1 2021, and desktop video programmatic risk decreasing by 3.9 percentage points to 1.4%.

Decreases in alcohol and disinformation content led brand risk improvements

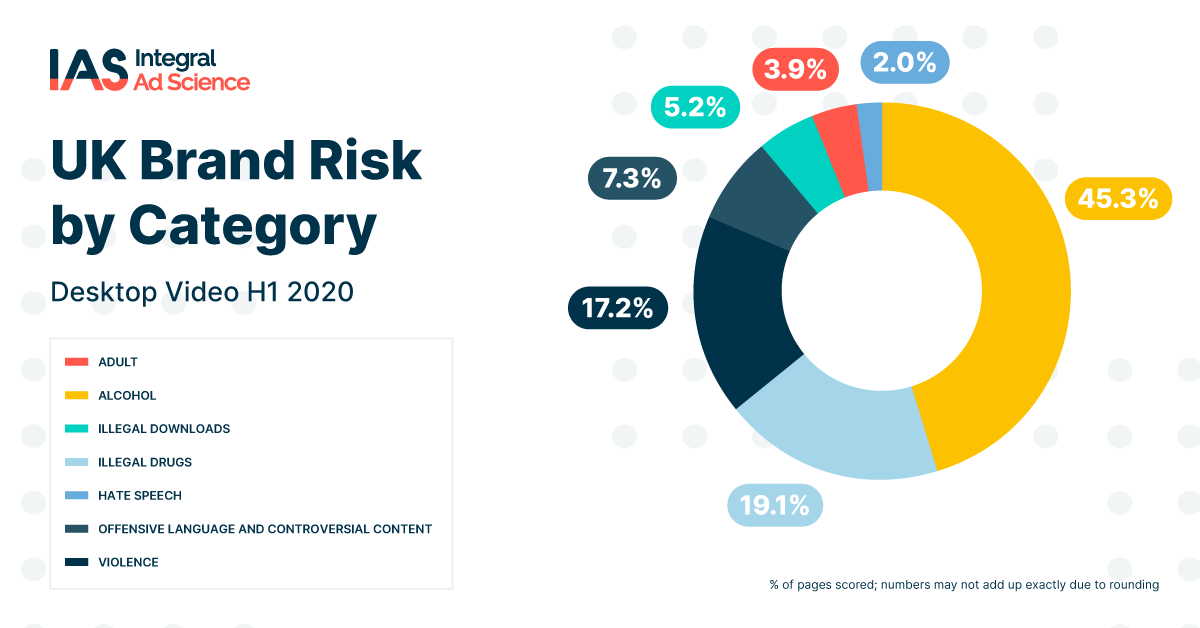

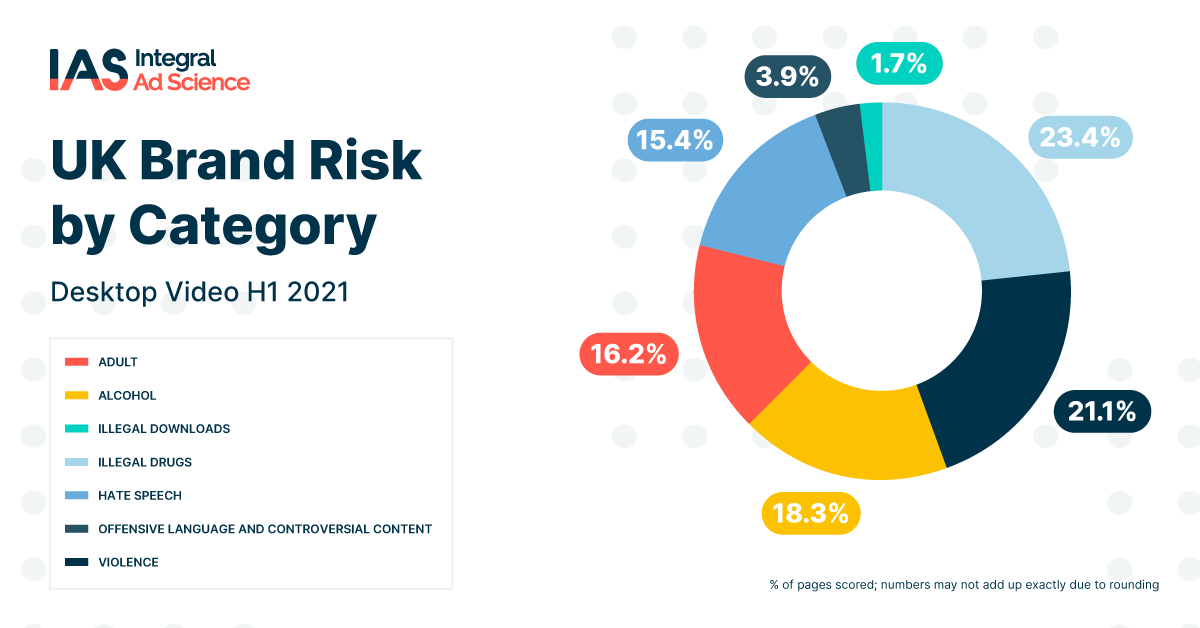

The data revealed significant changes in brand risk share between content categories that pose a threat to brands:

- There was a significant YoY improvement in the proportion of alcohol-related impressions flagged across all inventory types. In particular, desktop video decreased 27 percentage points from 45.3% in H1 2020 to 18.3% in H1 2021, while desktop display fell by 26.4 percentage points from 45.4% to 19%.

- Industry-wide efforts and greater education to reduce the prevalence of offensive language and fake news are proving successful. The risk of appearing near offensive or controversial content, such as disinformation, has reduced across all environments. Mobile web display led the way in this risk category as its share dropped 5.7 percentage points from 11.1% in H1 2020 to 5.4% in H1 2021.

- Adult, hate speech and violence content categories generally contributed a larger portion of brand risk across various environments when compared to the previous year. Specifically, the share of brand risk around adult content across desktop display increased 11.9 percentage points from 6.3% in H1 2020 to 18.2% in H1 2021. Hate speech across desktop video increased 13.4 percentage points from 2% to 15.4% in H1 2021. And violence also presented a brand safety threat, with 36.1% of mobile web video ad impressions flagged as posing a risk including content around violence.

Video ads drive greater viewability and completion rates

Advertisers using video to engage with audiences found that they were more viewable than display ads. Viewability across mobile web video increased from 72.5% in H1 2020 to 74.9% in H1 2021, as did viewability across desktop video (from 73.5% to 74.4%). Additionally, 79% of viewable desktop video ads remained in view to completion, and 73.5% of mobile web video ads. In contrast, viewability across mobile web display decreased from 72.5% in H1 2020 to 69.2% in H1 2021, as did viewability across mobile app display (73.5% to 72.1%) and desktop display (72.9% to 71.5%).

Advertisers have less time to engage audiences in the UK, compared to global averages

Mobile app display showcased the sharpest drop of impressions that remained in view, decreasing from 24.51 seconds in H1 2020 to 18.12 seconds in H1 2021. Across desktop display, time-in-view of ads in the UK stood at an average of 21.16 seconds, compared to the global average of 22.67 seconds. This highlights advertisers’ need to ensure ads attract attention within a more competitive environment.

UK ad fraud rates remain below global average

Occurrences of ad fraud in the UK varied depending on ad inventory type, but still remained below global averages. Within advertising campaigns that used optimisation tools, the UK had the joint-second lowest level of ad fraud rates across mobile environments. On mobile web display, ad fraud decreased from 0.5% to 0.2% in H1 2021 (versus a global average of 0.4%). Even on desktop display, ad fraud increased from 0.6% to 0.9% in H1 2021, but was still below the global average of 1%. Campaigns that did not incorporate a form of fraud mitigation strategy encountered levels of fraud up to 13x higher worldwide.

For more insights download the report today.

Share on LinkedIn

Share on LinkedIn Share on X

Share on X